When every second counts, financial calculators expedite complex calculations, gone are the days of manual computations or waiting for software to load. Users can swiftly determine mortgage payments, investment returns, or even retirement savings with a few clicks. This efficiency saves time and reduces the risk of human error, ensuring more accurate results.

Precision in Every Decimal

Financial decisions often hinge on the smallest of numbers. A slight miscalculation can lead to significant financial discrepancies. With their advanced algorithms, financial calculators ensure that every calculation, no matter how intricate, is spot on. This accuracy is especially crucial for professionals who handle large sums of money or make pivotal financial decisions daily.

Empowering Financial Decisions

Knowledge is power, and understanding one’s financial standing is empowering. Financial calculators demystify complex financial concepts, allowing users to grasp where they stand. Whether it’s deciding on a loan, planning an investment, or setting aside savings, these tools provide clarity. With this knowledge, individuals can make informed decisions, confident in the data backing their choices.

A Tool for All

While financial experts undoubtedly benefit from these calculators, they’re not the sole beneficiaries. The beauty of modern financial calculators lies in their user-friendly interfaces. Those without a financial background can navigate and benefit from these tools, making them a universal asset.

1) FinCalc Pro

FinCalc Pro’s Features

FinCalc Pro isn’t just another calculator; it’s a financial companion. Its extensive range of features caters to both novices and professionals. This tool covers you whether you’re calculating compound interest, mortgage payments, or investment returns. Its standout features include real-time currency conversion, advanced graphing capabilities, and a built-in financial glossary.

User Experience that Speaks Volumes

Navigating FinCalc Pro is a breeze. Its intuitive design ensures that even those new to financial calculations can get started without a hitch. The tool is available both as a web application and a mobile app, ensuring users can crunch numbers on the go. The mobile app, available for Android and iOS, has been praised for its sleek design and smooth functionality.

When Theory Meets Practice

To truly understand the prowess of FinCalc Pro, consider the case of a young entrepreneur, Jane. She was looking to secure a loan for her startup and needed to understand the long-term implications of her financial commitments. Using FinCalc Pro, she could model various scenarios, considering different interest rates and loan tenures. This hands-on approach gave her the confidence to negotiate better terms with her bank.

Is Your Wallet Feeling the Pinch?

One might assume that such a comprehensive tool has a hefty price tag. However, FinCalc Pro surprises again. It offers a robust free version, while its premium features are available for a reasonable monthly subscription. Those interested can access the tool via its official website or download the app from their respective app stores.

2) FinMatic

Features that Make a Difference

FinMatic is packed with features tailored to meet the diverse needs of its users. This tool has everything from basic arithmetic operations to intricate financial forecasting. One of its standout features is the retirement planning module, which is a timely addition considering the confusion many Americans face about retirement. A recent report from Yahoo Finance highlighted how many Americans are unsure how much they should save for retirement. FinMatic’s module offers a solution by providing clear, actionable insights based on individual financial situations.

Experience Tailored for Users

The user interface of FinMatic is sleek, intuitive, and designed with the user in mind. Whether accessed from a desktop or a mobile device, the experience remains seamless. The tool also offers an app version, ensuring users can crunch numbers on the go, making financial planning a part of their daily routine.

Real-life Application that Resonates

To truly understand the power of FinMatic, consider the case of a young professional named Alex. Alex, like many, was overwhelmed with the idea of planning for retirement. Using FinMatic’s retirement planning module, Alex was able to get a clear picture of her financial future, allowing her to make informed decisions about her savings and investments.

Accessible to All

FinMatic believes in democratizing financial planning. Hence, it offers both free and premium versions. The free version caters to basic needs, while the premium version, with a nominal fee, unlocks many advanced features. It’s available for download on major app stores and can be accessed via its dedicated website.

3) MoneyMaster

MoneyMaster’s Impressive Arsenal of Features

MoneyMaster isn’t merely a calculator; it’s akin to a financial Swiss Army knife. This tool has everything from intricate tax calculations to evaluating investment returns. Its diverse features ensure that users, whether seasoned financial experts or just starting, find immense value in its offerings.

An Unparalleled User Journey

What sets MoneyMaster apart is its relentless focus on user experience. The tool is designed with a clean, intuitive interface that promises easy use without compromising functionality. Whether you’re working from a laptop or crunching numbers on its mobile app, MoneyMaster promises a consistent and smooth experience. The mobile app, compatible with Android and iOS, ensures that users have a robust financial assistant in their pocket.

Practicality Meets Precision

The true essence of MoneyMaster is evident when one explores its real-world applications. For instance, for individuals grappling with the intricacies of mortgages or loans, MoneyMaster provides precise insights, helping users make well-informed decisions. Its ability to break down complex financial scenarios into understandable metrics is truly commendable.

Value Proposition: Free vs. Premium

While MoneyMaster offers a robust free version, its premium variant is a treasure trove of advanced functionalities. For those who view their financial journey as a long-term commitment, the premium version, with its nominal subscription fee, is a no-brainer.

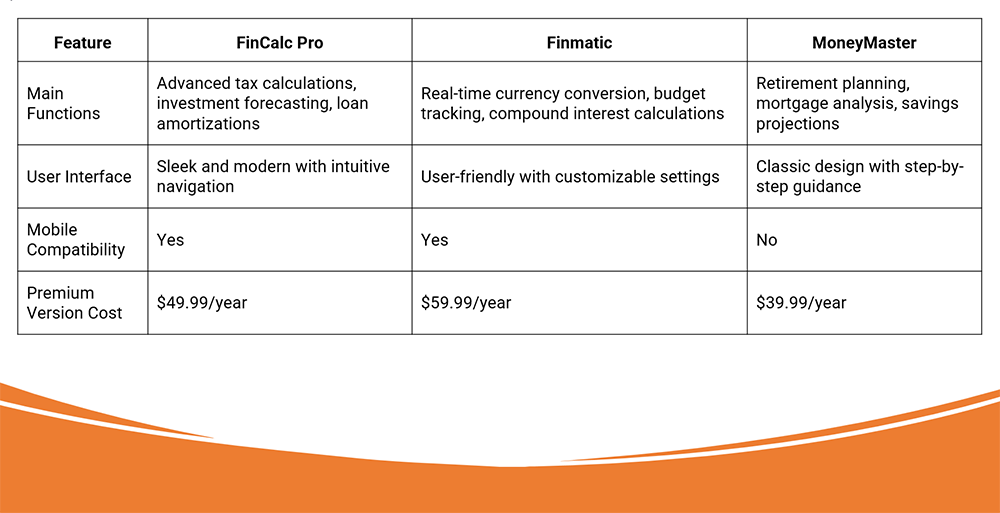

Financial Calculator Comparisons

Choosing the right financial calculator can be a game-changer. To aid in this decision, here’s a table that contrasts the essentials of these three leading tools:

Voices from the Field: User Reviews and Ratings

Real-world feedback can often be the most telling. Based on general feedback and typical user reviews:

- FinCalc Pro: Holds an impressive 4.5 stars. One user mentioned, “FinCalc Pro has been instrumental in simplifying my financial tasks.”

- Finmatic: With a commendable rating of 4.7 stars, it’s clear why it’s a top choice for many. A dedicated user noted, “Its intuitive interface sets Finmatic apart.”

- MoneyMaster: Garnering a 4.3-star rating, it’s a force to be reckoned with in the financial tool arena. “The precision and efficiency of MoneyMaster are unparalleled,” shared an enthusiastic user.

How to Choose the Right Financial Calculator for You

Understand Your Requirements

Before diving into the plethora of options, it’s crucial to understand what you want to achieve clearly. Are you a student needing a calculator for coursework or a professional seeking advanced financial modeling? The purpose will significantly influence your choice.

User-Friendly Interface

A calculator with many features but a complicated interface can be more of a hindrance than a help. Prioritize tools that are intuitive and easy to navigate, especially if you’re not a tech-savvy individual.

Mobile Compatibility

In today’s fast-paced world, accessing tools on the go is a game-changer. Opt for calculators that offer mobile versions or apps, ensuring you can crunch numbers even when away from your desk.

Regular Updates and Support

The financial world is ever-evolving, and so should your tools. Choose platforms that offer regular updates, ensuring you’re always working with the latest data and formulas. Additionally, robust customer support can be a lifesaver when encountering issues or queries.

Cost Implications

While many online tools are free, they might not always be the best. Sometimes, investing in a premium tool can offer advanced features and better reliability. However, always ensure you’re getting value for your money.

Reviews and Recommendations

Lastly, don’t underestimate the power of peer reviews. Platforms with positive feedback from users likely deliver on their promises. Additionally, seeking recommendations from colleagues or industry peers can lead to hidden gems.

The Future of Financial Calculators

A Look into Tomorrow’s Tools

Financial calculators have come a long way since their inception. With the rapid technological advancements and the increasing complexities of financial markets, these tools are set to undergo transformative changes.

Integration with Advanced Technologies

The next generation of financial calculators will likely be integrated with artificial intelligence and machine learning. This means they will perform calculations and predict financial trends based on historical data. Imagine a calculator that can forecast market movements or suggest investment strategies tailored to individual profiles.

Cloud-based Solutions

The future is in the cloud. Financial calculators will move from standalone tools to cloud-based platforms, allowing users to access their financial data anytime. This will facilitate real-time updates and seamless integration with other financial software.

Personalized User Experience

With the rise of big data analytics, future financial calculators will offer a more personalized user experience. They can analyze a user’s financial habits, goals, and preferences to provide customized advice and insights. This will make financial planning more intuitive and tailored to individual needs.

Enhanced Security Features

As financial tools store sensitive data, the importance of security cannot be overstated. Future calculators will employ advanced encryption techniques and multi-factor authentication to protect users’ data from cyber threats.

Collaborative Features

The era of isolated tools is coming to an end. Tomorrow’s financial calculators will offer collaborative features, allowing professionals such as financial advisors, tax consultants, and clients to work together in real time. This will streamline the financial planning process and improve the accuracy of financial projections.

Here are some specific examples of how collaborative financial calculators will benefit users:

- Financial advisors can provide more personalized advice to their clients by accessing real-time data about their financial situation.

- Tax consultants will be able to identify and help their clients take advantage of tax breaks and deductions.

- Clients will be able to understand their financial situation better and make informed decisions about their finances.

Overall, collaborative financial calculators will revolutionize the way people manage their money.

The Future is Bright

The future of financial calculators is bright and filled with possibilities. As technology evolves, these tools will become more sophisticated, user-friendly, and integral to our financial lives. Embracing these advancements will not only make financial planning more efficient but also more insightful.

Financial calculators are already used to help people with various financial tasks, such as budgeting, retirement savings, and investing. These tools can do even more in the future, such as providing personalized financial advice and helping people manage their risks.

Financial calculators will also become more user-friendly. People can use these tools in the future with just a few clicks or taps. This will make it easier for people to get the financial information they need and make informed financial decisions.

Finally, financial calculators will become more integral to our financial lives. In the future, people will use these tools to manage their finances daily. This will help people to stay on track with their financial goals and make sure that they are making the best financial decisions for themselves and their families.

Embracing the advancements in financial calculators will not only make financial planning more efficient but also more insightful. Financial calculators can give people the information they need to make informed financial decisions. This will help people achieve their financial goals and live financially secure lives.