Financial planners today face a rapidly shifting environment. Longer life expectancies, rising healthcare costs, and inflationary pressures mean that retirement planning has become more complex than ever. Clients are looking for clear strategies to safeguard their financial future while balancing lifestyle goals. This article explores the most pressing trends shaping retirement planning, highlights the implications for advisors, and provides actionable strategies that can help clients achieve sustainable financial security.

The Rising Cost of Retirement

Retirement is no longer a 15–20 year stage of life—it can easily last 30 years or more. This longevity risk adds pressure to portfolios and requires more robust planning.

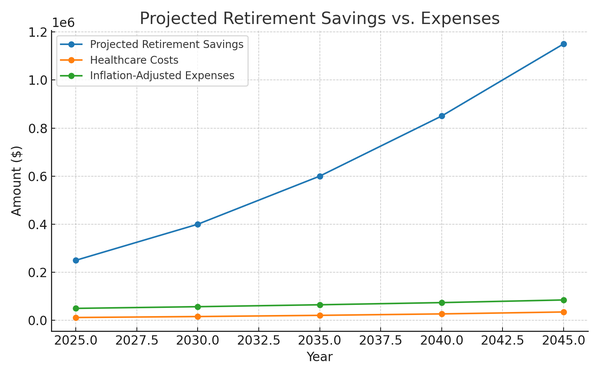

According to projections, the average retiree in 2025 will need about $50,000 annually in living expenses, increasing to over $85,000 by 2045 due to inflation. Meanwhile, healthcare costs—already one of the fastest-growing expense categories—are projected to nearly triple over the next two decades.

Expense Breakdown: Where the Money Goes

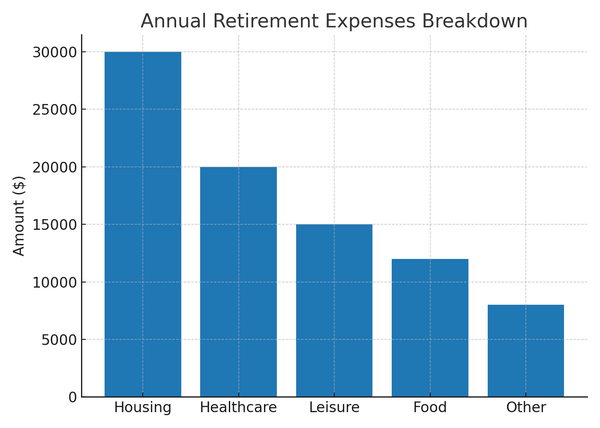

A well-rounded plan starts by understanding how retirees actually spend their money. While housing often remains the largest single expense, healthcare has emerged as a dominant concern, especially for clients over age 75.

- Housing ($30,000): Downsizing or relocating may lower costs, but property taxes, maintenance, and insurance still weigh heavily.

- Healthcare ($20,000): Medigap premiums, prescriptions, and long-term care drive up expenses.

- Leisure ($15,000): Travel and hobbies are priorities for many retirees, making this category important to preserve.

- Food ($12,000): Often underestimated in planning but steady throughout retirement.

- Other ($8,000): Transportation, gifts, and unexpected costs.

Inflation and Purchasing Power Risk

Inflation erodes the value of retirement savings. A $50,000 annual budget in 2025 could require $85,000 in 2045 to maintain the same standard of living. Even at moderate inflation rates of 2–3%, portfolios must grow significantly to avoid shortfalls.

Planning Tip: Use inflation-adjusted Monte Carlo simulations rather than static projections. This better illustrates how portfolios perform in varied economic conditions, giving clients a clearer sense of risk.

Longevity and Healthcare Challenges

Advances in medicine mean more clients will reach their late 80s and 90s. While positive, this also increases the likelihood of requiring long-term care. Current estimates show that 70% of retirees will need some form of long-term care, with costs ranging from $50,000 to $100,000 annually depending on the level of support.

- Explore hybrid life/long-term care insurance products.

- Stress-test portfolios under “late-life care” scenarios.

- Incorporate healthcare inflation (typically higher than general inflation) into planning models.

Sustainable Withdrawal Strategies

A core challenge for planners is balancing sustainable withdrawals with lifestyle goals. The traditional “4% rule” has lost some relevance in today’s environment of low yields and market volatility.

Alternative approaches include dynamic withdrawal strategies (adjusting spending in response to market returns), bucket strategies (short-term cash reserves, medium-term bonds, long-term equities), and the guardrails approach (increasing or decreasing withdrawals based on portfolio performance). These methods can reduce the risk of portfolio depletion while offering clients flexibility.

The Role of Tax Planning

Taxes can erode retirement income as much as inflation or healthcare. Financial planners should integrate tax-efficient withdrawal strategies: prioritize drawing from taxable accounts before tax-deferred accounts, use Roth conversions strategically during lower-income years, and advise on Required Minimum Distributions (RMDs) to minimize unexpected tax hits. By layering tax strategy into income planning, advisors can stretch portfolios further.

Technology and Data-Driven Planning

Today’s financial planners can leverage advanced tools for scenario modeling, tax optimization, and risk assessment. AI-driven analytics are making it possible to integrate client health, spending patterns, and market conditions into holistic plans. Clients increasingly expect interactive planning experiences—not static binders. Digital dashboards and real-time scenario testing can deepen engagement and reinforce the planner’s value.

Putting It Into Practice

The retirement landscape is more complex than ever, but this complexity creates opportunities for advisors to deliver greater value. By addressing inflation, longevity, healthcare, and tax considerations in an integrated way, financial planners can help clients not only accumulate wealth but also preserve it through decades of retirement.

With strategic guidance, planners can turn uncertainty into confidence—ensuring that clients enter retirement with both peace of mind and financial security.

Disclaimer: This article is for informational purposes only and is not investment, tax, legal, or medical advice. Assumptions and figures are illustrative. Readers should do their own research before making any financial decisions.