What Are CD Rates?

A Certificate of Deposit (CD) is a fixed-term investment option offered by banks and credit unions, allowing customers to deposit funds for a specified period in return for a fixed interest rate. CD rates are the interest rates paid on these deposits, and they vary widely based on several factors, including the bank, the length of the CD term, and the current economic conditions. Generally, CD rates tend to be higher than traditional savings accounts because of the commitment required by the depositor, who agrees not to withdraw the funds until the term is complete. The standard CD lengths are three months, six months, one year, and longer, with rates often higher for shorter terms, contrary to typical investment logic where longer terms yield higher returns.

Why Are CD Rates Important?

Understanding CD rates is crucial for savers looking to maximize returns on their deposits. When banks offer attractive CD rates, they present an opportunity for consumers to earn a guaranteed return, making CDs a safe investment alternative to stocks or other volatile options. However, CD rates are influenced by multiple economic factors, including Federal Reserve policies, inflation rates, and the overall economic outlook. These variables can lead to fluctuations in rates over time, making it vital for investors to keep up with current rates and trends.

CD Rates vs. Dividend Rates: What’s the Difference?

Though similar in function, CD interest rates and dividend rates are not the same. CD interest rates represent the earnings paid on a CD by banks, calculated as a percentage of the deposit amount. Dividend rates, however, are often associated with credit unions and refer to the income shared with depositors based on the institution’s earnings. While both offer a return on deposits, dividend rates depend more on the institution’s performance and may vary over time, whereas CD interest rates are fixed upon opening the CD.

Current CD Rates at Major Banks

When considering where to open a CD, many look at top financial institutions like Chase, Bank of America, and PNC Bank. Here’s a brief look at the current landscape of CD rates among popular banks:

- Chase Bank: Chase’s CD rates may vary significantly depending on term length and deposit amount. Currently, shorter terms often have higher rates than longer terms, as banks seek to attract short-term deposits in a fluctuating economic environment.

- Bank of America: Known for traditionally conservative rates, Bank of America’s CD offerings may seem lower compared to other competitors. The lower rates are often attributed to the bank’s reliance on other financial services for revenue rather than deposit accounts alone.

- PNC Bank: PNC’s CD rates have also been on the lower end, a trend attributed to economic conditions and the bank’s financial strategy focused on other revenue streams.

- Edward Jones: Edward Jones offers competitive rates for CDs with varied terms, typically favored by those looking for financial services bundled with investments.

Who Has the Best CD Rates?

Identifying the best CD rates requires evaluating both traditional banks and credit unions, as well as smaller, online-only banks. Often, online banks such as Ally Bank, Marcus by Goldman Sachs, and Capital One offer higher rates than traditional banks because they operate with lower overhead costs. Current trends reveal that credit unions and some smaller banks may provide rates that surpass those of larger, national banks.

Will CD Rates Increase in 2024?

As of recent projections, CD rates may see a gradual increase in 2024, largely due to the Federal Reserve’s ongoing adjustments in response to inflation. When the Fed raises interest rates, banks typically follow by increasing their own rates for both loans and deposits, including CDs. However, the extent of these increases depends on inflation rates and the overall economic recovery. Savvy investors may want to keep an eye on Fed announcements as they consider locking in CD rates or exploring shorter terms.

Timing Your CD Investments: When to Lock In Rates

Knowing when to lock in a CD rate is essential to optimizing returns. Investors often seek to lock in rates when they are high or anticipate economic conditions that could drive rates down. For example, in times of economic expansion and high inflation, locking in a rate could secure a higher return. Conversely, during economic downturns, it may be beneficial to choose shorter terms, allowing flexibility to reinvest at potentially higher rates as conditions improve.

Why Are Longer-Term CDs Sometimes Lower in Rate?

It may seem counterintuitive, but longer-term CDs sometimes offer lower rates than shorter-term options. This structure often occurs when banks anticipate interest rate drops in the future. By locking in lower long-term rates, banks hedge against the cost of paying higher rates in the short term while giving depositors a sense of stability. As a result, those looking for better returns on CDs might want to consider shorter terms or reevaluate as market conditions shift.

How Are CD Rates Calculated?

CD rates are determined by factors such as the length of the deposit term, the deposit amount, and prevailing economic conditions. Generally, higher deposit amounts and longer terms yield better rates, though this can vary depending on the institution’s current rate structure. Here’s a breakdown of how these rates are calculated:

- Interest Formula: Banks calculate interest based on the principal amount, rate, and term duration. The formula typically used is:

Interest=Principal×Rate×Time\text{Interest} = \text{Principal} \times \text{Rate} \times \text{Time}Interest=Principal×Rate×Time - Compound Interest: Most CDs compound interest monthly, quarterly, or annually, allowing interest to be added to the principal, resulting in increased earnings.

- Annual Percentage Yield (APY): APY represents the effective rate of return, accounting for compounding periods. Banks usually advertise the APY as it provides a clearer picture of the total return a depositor can expect over a year.

Expected CD Rates for 2025

Looking further ahead, projections for 2025 indicate potential stability or even a decline in CD rates, depending on inflation and Federal Reserve policies. In times of economic recovery, the Fed may reduce interest rates to stimulate borrowing and spending, leading to lower CD rates. Consequently, investors may want to take advantage of higher rates in 2024 if possible or opt for shorter CD terms to remain flexible for any rate increases.

How Often Do CD Rates Change?

CD rates are not static and may change periodically based on market and economic conditions. For instance, significant events like Federal Reserve rate hikes or economic downturns can lead banks to adjust CD rates within days or weeks. However, once a depositor locks in a CD rate, that rate remains fixed for the CD’s term, shielding the investor from subsequent changes.

Highest-Paying CD Rates Right Now

Currently, several online banks and credit unions are offering some of the highest CD rates. For instance, 12-month CDs at certain institutions may offer rates of 4% or more, while longer-term CDs hover around 3.5%. It’s worth noting that jumbo CDs, which require a higher minimum deposit (often $100,000 or more), sometimes offer even higher rates than standard CDs.

How Do Bank CD Interest Rates Work?

Bank CD interest rates work by offering a fixed return on deposits made for a specified term. The depositor receives the principal plus interest earned once the term concludes, with the rate locked in at the start. Some banks may offer add-on CDs, allowing depositors to add funds periodically, though these often come with lower rates to offset the flexibility.

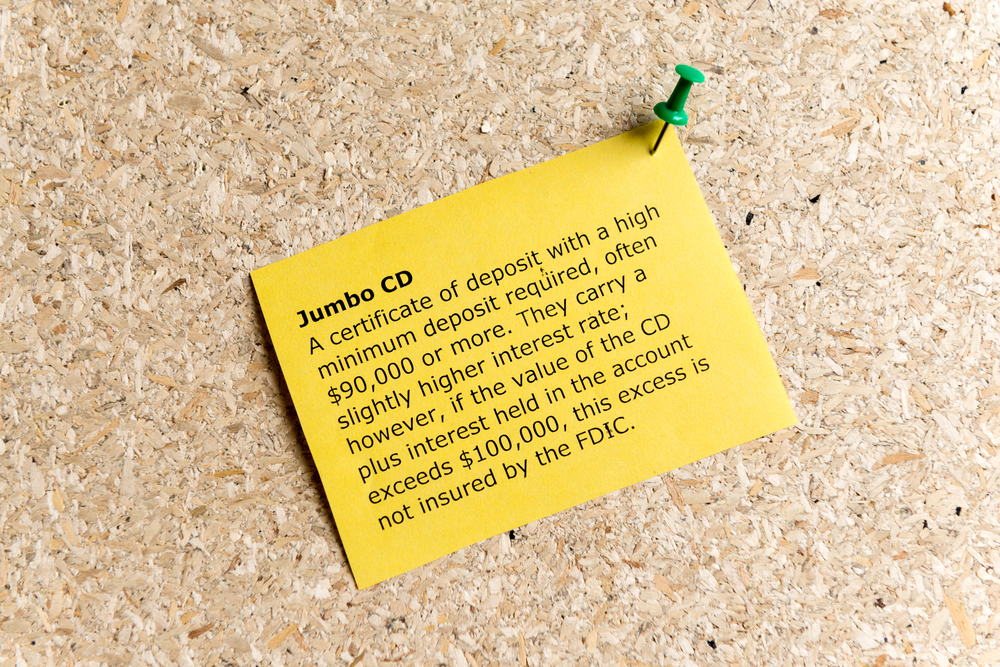

Comparing Jumbo CD Rates to Regular CD Rates

Jumbo CDs require higher minimum deposits, usually starting at $100,000. In return, they often provide higher rates than standard CDs, rewarding large deposits. However, not all banks offer significantly higher rates for jumbo CDs. Savers with substantial funds should compare jumbo CD rates across banks and credit unions to ensure they’re getting the best return.

When Will CD Rates Go Down?

Although rates are expected to rise in the near future, there may be a decline once inflation stabilizes and the Fed adjusts its policy to support economic growth. Depositors aiming to secure a higher rate may want to act within the current period of rising rates, as rate declines could follow a few years of economic recovery.

Selecting the Best CD Rates

When choosing a CD, consider factors like term length, minimum deposit requirements, and interest rate. Comparing rates between banks and credit unions helps ensure you get the best return on investment. Keep in mind that online banks often provide higher CD rates due to lower operating costs, making them a strong option for those comfortable with digital banking.

Finding the Best CD Rate

Investing in CDs offers a reliable way to earn fixed returns on savings, with terms and rates that vary widely across banks. By staying informed on current rates, understanding the impact of economic policies, and comparing options, you can make well-informed decisions to optimize your investment.