Why Compliance Matters

The consequences of non-compliance can be severe, ranging from hefty fines and legal repercussions to irreparable damage to a company’s reputation.

One glaring example that underscores the importance of compliance is the case of Enron, a U.S. energy company that collapsed due to widespread corporate fraud. The fallout was catastrophic, leading to employee layoffs, shareholder losses, and the dissolution of Arthur Andersen, one of the five largest audit and accountancy partnerships in the world. This case alone led to the enactment of the Sarbanes-Oxley Act, aimed at improving transparency in financial reporting by corporations.

The ramifications of non-compliance are not just legal or financial. A lapse in compliance can erode consumer trust, which is increasingly difficult to earn in today’s digital age. According to a survey by the National Business Ethics Survey, organizations with strong ethical cultures and compliance programs report 50% less misconduct and have 13 times more chances to retain employees than those without.

Moreover, non-compliance can also result in operational setbacks. For instance, failure to comply with data protection regulations can lead to data breaches, which not only attract fines but also disrupt business operations. According to Cybersecurity Ventures, the global damage costs due to cybercrime are expected to reach $6 trillion annually by 2021, and a significant portion of this could be mitigated by robust compliance programs.

Compliance is essential for businesses to avoid the serious consequences of non-compliance. By implementing strong compliance programs, businesses can protect themselves from financial losses, legal repercussions, and reputational damage.

Core Components of Any Compliance Program

When it comes to establishing a robust compliance program, understanding its core components is crucial. These are the foundational elements that not only ensure adherence to laws and regulations but also foster a culture of integrity within the organization.

1. Policies and Procedures

Detailed policies and procedures serve as the rulebook for compliance. These documents outline the dos and don’ts, providing clear guidelines for employees to follow. They should be easily accessible and regularly updated to reflect any changes in laws or business operations.

2. Risk Assessment

Before diving into compliance measures, organizations must identify potential risks. This involves a thorough analysis of various business operations to pinpoint areas that are susceptible to compliance failures. Risk assessments should be an ongoing process, continually updated to adapt to new challenges.

3. Compliance Team

A dedicated team of compliance professionals is essential for the effective implementation and monitoring of the program. This team is responsible for ensuring that the organization stays on the right side of the law, and they often report directly to the board of directors or CEO.

4. Training and Education

Ignorance of the law is no excuse. Organizations must invest in regular training sessions to educate employees about compliance requirements. These sessions should be tailored to different departments and roles, ensuring everyone understands their responsibilities.

5. Monitoring and Auditing

Regular audits and monitoring are vital for assessing the effectiveness of a compliance program. These processes help identify gaps or inconsistencies that need to be addressed. Utilizing software solutions for real-time monitoring can significantly enhance this component.

6. Enforcement and Discipline

A compliance program is only as strong as its weakest link. Organizations must have a system in place for dealing with non-compliance. This includes disciplinary actions and, in severe cases, legal proceedings.

7. Continuous Improvement

Compliance is not a one-time event but an ongoing process. Organizations should regularly review and update their compliance programs, considering feedback, audit results, and regulation changes.

By understanding and effectively implementing these core components, organizations can build a robust compliance program that is adaptable to the ever-changing regulatory landscape.

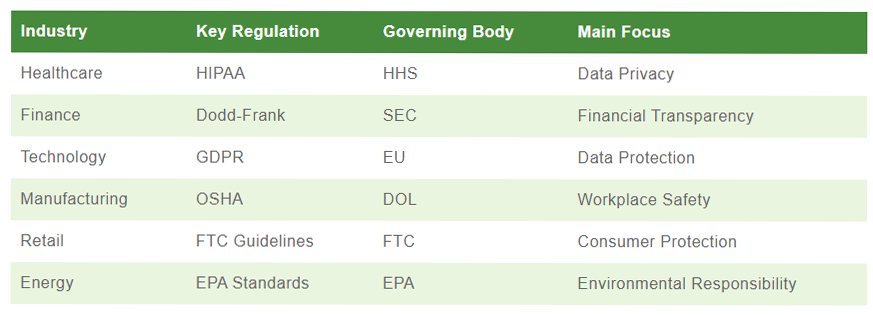

Key Regulations by Industry

Different industries have their own sets of rules, regulations, and governing bodies. Understanding these is the first step in building a robust compliance program tailored to your organization’s needs.

Healthcare – The Reign of HIPAA

The Health Insurance Portability and Accountability Act (HIPAA) is the cornerstone regulation for healthcare providers in the United States. It governs the privacy and security of patient information, requiring stringent measures to protect data.

Finance – The Dodd-Frank Wall Street Reform

The Dodd-Frank Wall Street Reform and Consumer Protection Act is pivotal in the financial sector. It aims to reduce risks in the financial system, requiring transparency and accountability from financial institutions.

Technology – The Global Impact of GDPR

For technology companies, especially those operating internationally, the General Data Protection Regulation (GDPR) is a key consideration. This European Union regulation has global implications, affecting how companies collect, store, and use personal data.

Manufacturing – OSHA

In manufacturing, the Occupational Safety and Health Administration (OSHA) sets the standards for workplace safety. Compliance with OSHA guidelines is crucial to avoid penalties and ensure the well-being of employees.

Retail – The FTC Guidelines

Retailers must pay close attention to Federal Trade Commission (FTC) guidelines governing advertising, promotions, and consumer protection. Non-compliance can result in hefty fines and reputational damage.

Energy – Adhering to EPA Standards

The Environmental Protection Agency (EPA) sets emissions and waste management guidelines for energy companies. Compliance is not just about avoiding fines; it’s also about corporate social responsibility.

Here’s a table comparing the key regulations across industries:

Understanding the regulatory landscape is crucial for building a comprehensive compliance program. Each industry has unique challenges and requirements, making it essential to tailor your compliance strategies accordingly.

Roles and Responsibilities Within A Compliance Team

A compliance team is a group of professionals responsible for ensuring that an organization complies with all applicable laws and regulations. The team typically includes the following members:

- Chief Compliance Officer (CCO): The CCO is responsible for the overall compliance program and reports directly to the CEO or the board.

- Compliance Analysts: Compliance Analysts conduct risk assessments, monitor policy adherence, and gather data for audits.

- Legal Advisors: They interpret laws and regulations and advise the team on implementing them within the organization.

- Training and Development Specialists: Training and Development Specialists create educational programs to keep staff informed and compliant.

- IT Compliance Specialists: IT Compliance Specialists ensure that the organization’s technology infrastructure complies with relevant laws and regulations.

- Internal Auditors: Internal Auditors regularly review processes and procedures to ensure they meet compliance standards.

- Ethics Officers: Ethics Officers focus on the moral aspects of business operations, ensuring that the organization’s activities align with ethical standards and legal requirements.

Each compliance team member brings a unique skill set and specialized knowledge, ensuring that the organization stays on the right side of the law while optimizing operational efficiency.

Conducting Risk Assessment

Risk assessment serves as the cornerstone of any robust compliance program. The process helps organizations identify, evaluate, and prioritize risks, laying the groundwork for effective policy development and implementation. Here’s a detailed guide on how to conduct a risk assessment.

Assemble a Cross-Functional Team

Gather experts from various departments such as legal, finance, and operations. Their diverse perspectives will provide a holistic view of potential risks.

Define the Scope

Clearly outline the areas that the risk assessment will cover. This could range from specific business processes to entire departments or even the organization as a whole.

Identify Risks

List all potential risks that could affect the organization. These could be financial, operational, legal, or reputational risks. Use tools like SWOT analysis or PESTLE analysis to ensure a comprehensive list.

Categorize Risks

Group the identified risks into categories. This helps understand the nature of each risk and aids in developing targeted compliance policies.

Evaluate Risks

Assign a likelihood and impact score to each risk. Use a risk matrix to visualize where each risk falls and to prioritize them accordingly.

Consult Regulatory Guidelines

Review relevant laws and regulations to understand the compliance requirements for each identified risk. This ensures that the risk assessment aligns with legal mandates.

Develop a Risk Mitigation Plan

For each high-priority risk, create a mitigation plan detailing the steps to reduce or eliminate the risk. Include responsible parties, timelines, and resources needed.

Document Everything

Maintain a detailed record of the risk assessment process, findings, and mitigation plans. This documentation serves as evidence of due diligence in case of regulatory scrutiny.

Review and Update

Risk landscapes are dynamic. Regularly review and update the risk assessment to account for new risks and changes in existing ones.

Leverage Technology

Consider using risk assessment software to streamline the process. Tools like Sparta Systems’ TrackWise or LogicGate can automate many aspects of risk assessment, making it more efficient and accurate.

Risk assessment is not a one-time activity but an ongoing process. It requires the involvement of multiple stakeholders and adherence to regulatory guidelines. By following these steps, organizations can build a solid foundation for their compliance program, ensuring that they are well-prepared to manage any risks that come their way.

Policy Development and Implementation

Policies serve as the backbone that holds the entire structure together. These are not mere documents but actionable guidelines that define what is acceptable and what is not within an organization. The policy development and implementation process is meticulous, requiring a deep understanding of internal operations and external regulations.

The Creation of a Policy

The first step in policy development is identifying the need. This usually stems from the risk assessment phase, where gaps and vulnerabilities within the organization are highlighted. Once the need is established, a draft policy is created, often involving legal advisors to ensure that the policy is in line with current laws and regulations.

Stakeholder Involvement

It’s crucial to involve key stakeholders in the policy development process. This includes not just the compliance team but also department heads, legal advisors, and even frontline employees who the policy will directly impact. Their input can provide valuable insights into the practicality and feasibility of the proposed guidelines.

The Approval Process

Once the draft is ready, it goes through a rigorous approval process. This often involves multiple rounds of revisions and reviews. The policy is then formally approved by the senior management and, in some cases, the board of directors.

Rolling it Out

Implementation is the next critical step. This involves disseminating the policy through internal memos, training sessions, and digital platforms. It’s essential to ensure that every employee understands the policy’s implications, from top-level management to the newest recruit.

Monitoring and Feedback

Post-implementation, the policy needs to be regularly monitored for effectiveness. Key Performance Indicators (KPIs) should be established to measure compliance. Feedback loops with employees can provide insights into any challenges faced during implementation, allowing for timely revisions.

Software Solutions

Modern compliance software can streamline both the development and implementation processes. Tools like PolicyTech and Convercent offer features like template libraries, approval workflows, and monitoring dashboards, making it easier to manage policies effectively.

In addition to the above, here are some other important considerations for policy development and implementation:

- The policy should be clear, concise, and easy to understand.

- The policy should be specific and measurable.

- The policy should be consistent with other policies and procedures.

- The policy should be communicated effectively to employees.

- The policy should be monitored and enforced.

- The policy should be reviewed and updated regularly.

By following these guidelines, organizations can develop and implement effective compliance policies that help to protect their employees, customers, and stakeholders.

Monitoring and Auditing

Continuous monitoring is a proactive approach to compliance that involves ongoing assessment of compliance risks and activities. This can be done through various methods, such as reviewing documentation, conducting interviews, and observing employee behavior. Continuous monitoring can help organizations identify and address compliance issues before they become significant problems.

Auditing: The Periodic Health Check

Auditing is a retrospective approach to compliance that thoroughly reviews compliance activities and records. Internal or external auditors can conduct audits, typically involving interviews, document reviews, and observation of employee behavior. Audits can help organizations identify compliance issues that may have been missed during continuous monitoring, and they can also help organizations improve their compliance programs.

Key Performance Indicators (KPIs)

Identifying the correct KPIs is critical for effective monitoring and auditing. These could range from the number of reported compliance incidents to the time taken to resolve them. The KPIs should be aligned with the organization’s compliance goals and be measurable, achievable, and relevant.

Software Solutions for Monitoring and Auditing

In today’s digital age, leveraging technology for compliance monitoring and auditing is not just advisable; it’s indispensable. LogicGate and MasterControl offer features like automated audit trails, real-time monitoring, and comprehensive reporting, making the task less daunting and more efficient.

Legal Implications

Failure to adequately monitor and audit can result in severe legal repercussions, including hefty fines and even imprisonment in extreme cases. Therefore, taking these processes seriously and investing in them adequately is imperative.

Responding to Non-Compliance

Even the most robust compliance programs can encounter instances of non-compliance. How an organization responds to these situations can significantly impact its reputation, not to mention the potential legal repercussions. Here is a comprehensive guide to managing non-compliance effectively:

- Immediate Action is Crucial

Upon discovering a compliance issue, it is imperative to take immediate action. The first step is to contain the situation to prevent further violations. This may involve suspending the activity in question or isolating the department concerned. - Internal Investigation

An internal investigation should be launched promptly. This involves gathering all relevant data, conducting interviews, and documenting findings. Specialized compliance software can assist in organizing and analyzing this information. - Legal Consultation

Consulting legal experts is a critical step. They can provide insights into the potential legal ramifications and guide the organization on the best action to minimize liability. - Transparency with Regulatory Bodies

Reporting the incident to relevant regulatory bodies may be mandatory depending on the severity and nature of the non-compliance. Transparency is key here, as failure to report can result in severe penalties. - Corrective Measures

Once the issue has been thoroughly investigated, corrective measures must be implemented. This could range from revising policies and procedures to conducting targeted employee training sessions. - Communication Strategy

It is essential to have a communication strategy in place. This involves informing stakeholders about the incident and the steps taken to resolve it. Transparency in communication can go a long way in rebuilding trust. - Review and Update

After the situation has been resolved, it is crucial to review the incident to understand its root cause. This is an opportunity to update and strengthen the compliance program to prevent similar incidents in the future.

Training and Awareness

A well-informed team is the first line of defense against compliance violations. Therefore, training and awareness programs are not mere formalities but critical components of a robust compliance program.

The Importance of Training

Training equips employees with the knowledge and skills to navigate the complex regulations and internal policies landscape. It’s not just about ticking off a box; it’s about fostering a culture of compliance within the organization. According to a Compliance and Ethics Leadership Council study, companies with robust training programs reduce compliance risks by up to 50%.

Types of Training Programs

- Onboarding Training: Introduce new hires to the company’s compliance policies and procedures.

- Ongoing Training: Regular updates and refresher courses to keep the team abreast of any regulation changes.

- Specialized Training: Targeted programs for departments or roles that deal with specific compliance issues, such as data protection or financial reporting.

Measuring Effectiveness

How do you know if your training program is effective? Key Performance Indicators (KPIs) like employee engagement levels, quiz scores, and real-world training application can offer insights. Tools like Learning Management Systems (LMS) can track these metrics and provide valuable data.

Legal Requirements

Some industries have legal mandates for compliance training. For instance, the healthcare sector must adhere to HIPAA training requirements, while financial institutions often have specific training mandates under laws like the Sarbanes-Oxley Act.

Best Practices

- Use real-world scenarios to make training relatable.

- Include assessments to gauge understanding and retention.

- Keep training modules short and focused to improve engagement.

Training and awareness are not just about avoiding penalties; they’re about creating a culture where compliance becomes second nature. By investing in comprehensive training programs, organizations mitigate risks and empower their teams to act as custodians of compliance.