The Growing Appeal of Sustainable Investing

In recent years, sustainable investing has moved from the fringes of portfolio management into the mainstream for many financial planners and advisors. Clients across various age groups and wealth levels are increasingly seeking investments that align with their values—whether that means supporting renewable energy, promoting gender equality in corporate leadership, or backing companies with strong community engagement. For advisors, meeting this demand requires more than simply adding a “green” label to existing portfolios; it calls for a thoughtful approach to integrating environmental, social, and governance (ESG) factors without compromising on long‑term goals and risk parameters.

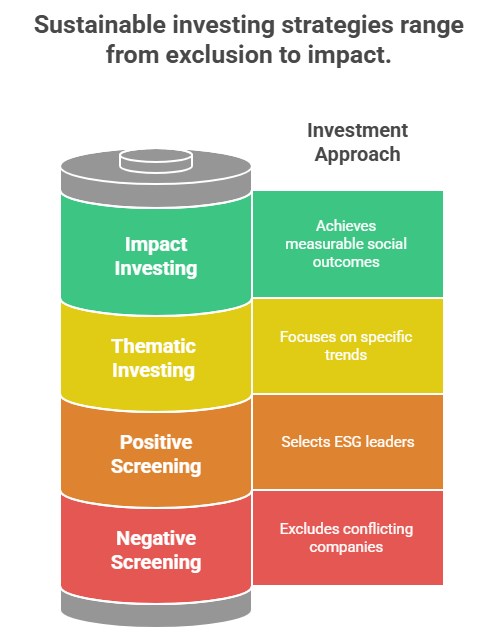

Understanding Sustainable Investing Approaches

Sustainable investing encompasses a spectrum of strategies, ranging from negative screening—excluding companies or sectors that conflict with client values—to positive screening, which actively selects companies demonstrating leadership in ESG practices. Other methods include thematic investing, where portfolios focus on specific trends, such as clean technology or affordable housing, and impact investing, which seeks to achieve measurable social or environmental outcomes alongside financial returns. Advisors should familiarize themselves with the nuances of each approach, recognizing that no single strategy will suit every client. By clearly explaining the trade‑offs and potential benefits of each method, advisors can guide clients toward the option that best aligns with their priorities and risk tolerance.

Aligning Client Values with Portfolio Choices

Effective sustainable investing begins with thorough client conversations. Beyond the standard risk‑tolerance questionnaire, advisors can use guided exercises—such as value‑ranking worksheets or storytelling exercises—to uncover which ESG issues resonate most deeply with clients. For some, carbon reduction may be the top priority; for others, workplace diversity or supply-chain transparency may be more important. By mapping these values onto investment options, advisors can build portfolios that feel personally meaningful to clients, reinforcing their commitment and reducing the likelihood of emotional selling during market turbulence. When clients see their portfolios reflect what they care about, engagement tends to improve, potentially leading to better long‑term outcomes.

Assessing ESG Data and Methodologies

One of the biggest challenges in sustainable investing is the sheer volume and variability of ESG data. Multiple rating agencies offer their own scores, often with divergent methodologies and coverage gaps. Advisors must learn to read beyond headline scores, examining the underlying metrics—such as greenhouse‑gas emissions intensity, board diversity statistics, or community impact policies—and understanding how data providers weight each category. A rigorous due-diligence process may involve cross-referencing scores, analyzing company-published sustainability reports, and consulting third-party research. By developing a structured framework for ESG evaluation, advisors can ensure greater consistency and transparency in portfolio construction.

Balancing Sustainable Goals with Performance Expectations

A common misconception is that sustainable portfolios underperform their traditional counterparts. While early studies suggested a potential trade-off, more recent analyses indicate that incorporating ESG factors can help identify better-run companies and uncover material risks, thereby supporting comparable—and in some cases superior—long-term performance. Nonetheless, advisors should set realistic expectations. Specific themes, such as low-carbon energy, may experience periods of underperformance relative to broader markets. Open client dialogue about potential volatility, time horizons, and the importance of diversification remains essential. Framing sustainable investments as part of a balanced strategy—rather than a standalone “cause” portfolio—helps align performance expectations with overall financial goals.

Implementing Sustainable Strategies in Practice

Putting sustainable investing into action involves identifying suitable vehicles, ranging from ESG-screened mutual funds and exchange-traded funds (ETFs) to separately managed accounts focused on impact objectives. Advisors should weigh factors such as fund fees, tax considerations, and minimum investment requirements. Additionally, they can explore direct investing opportunities in private impact funds or community development projects for high‑net‑worth clients seeking deeper engagement. Operational considerations—such as ensuring proper reporting, facilitating client access to ESG dashboards, and coordinating with custodians on shareholder advocacy initiatives—also play a crucial role. A clear implementation plan, supported by workflow templates and technology tools, will streamline the process and free up time for client advisory.

Navigating Regulatory and Compliance Questions

The regulatory environment for sustainable investing is evolving rapidly. In the U.S., the Securities and Exchange Commission has signaled increased scrutiny of ESG disclosures and “greenwashing” claims. At the same time, across the Atlantic, the European Union’s Sustainable Finance Disclosure Regulation (SFDR) imposes stringent reporting requirements. Advisors must stay informed about disclosure obligations, suitability considerations, and fiduciary standards that now increasingly factor in ESG risks. Developing a compliance playbook—covering marketing materials, client questionnaires, and due‑diligence documentation—can help firms preempt regulatory inquiries and maintain client trust.

Evolving with Client Expectations

As client interest in sustainable investing continues to grow, financial planners and advisors have an opportunity to deepen relationships by offering solutions that reflect both personal values and economic objectives. By understanding the spectrum of sustainable strategies, rigorously evaluating ESG data, balancing performance expectations, and navigating the shifting regulatory landscape, advisors can integrate sustainable investing into their practice in a way that feels authentic and impactful. In doing so, they not only respond to client demand but also position their firms for long‑term relevance in a changing marketplace.