Microsoft Excel stands as an indispensable cornerstone for finance professionals across all tiers, from entry-level investment analysts to seasoned Chief Financial Officers. Its enduring prominence stems from a unique blend of attributes: unparalleled flexibility in data manipulation, a remarkably powerful calculation engine capable of complex computations, and broad accessibility that makes it a universal standard within the industry. These characteristics collectively solidify its position as arguably the most critical software tool in any comprehensive financial toolkit.

While the financial technology landscape has certainly evolved, witnessing the rise and increased adoption of specialized tools such as Python for advanced quantitative analysis or Power BI for sophisticated business intelligence and data visualization, Excel has remarkably maintained its preeminence. It consistently remains the default, go-to platform for critical tasks requiring real-time adaptability, granular control over data, and iterative exploration. This includes, but is not limited to, dynamic real-time analysis of market fluctuations, the meticulous construction of intricate financial models for valuation and forecasting, and supporting the agile, informed decision-making processes that are paramount in the fast-paced world of finance. Its intuitive grid-based interface, combined with its vast array of functions and formulas, allows professionals to quickly prototype ideas, perform sensitivity analysis, and present complex financial scenarios in a clear, digestible manner.

Why Excel Remains Essential in Financial Analysis

Before diving into specific use cases, it’s worth understanding why Excel continues to be an essential tool for financial analysis:

- Flexibility: You can build customized models, dashboards, and calculators with relative ease.

- Ubiquity: Almost every company uses Excel, making it a universally accepted platform for collaboration.

- Speed: Analysts can quickly manipulate large datasets without requiring programming skills.

- Integrations: Excel can pull data from databases, APIs, ERP systems, and external platforms.

- Advanced Tools: With tools like Power Query, Power Pivot, and Solver, Excel has evolved far beyond simple spreadsheets.

1. Financial Modeling

Overview:

Financial modeling is one of the most critical and advanced applications of Excel. These models are used to forecast a company’s financial performance, simulate scenarios, and value companies or investments.

Key Applications:

- 3-Statement Models: Link the income statement, balance sheet, and cash flow statement dynamically.

- Discounted Cash Flow (DCF) Analysis: Calculate intrinsic value using future cash flows and discount rates.

- Merger and Acquisition (M&A) Models: Evaluate accretion/dilution and synergies in a potential deal.

- Leveraged Buyout (LBO) Models: Analyze capital structure and returns in private equity transactions.

Useful Excel Tools:

- NPV, IRR, XNPV, XIRR functions

- Scenario and sensitivity analysis using data tables

- Goal Seek and Solver for optimization problems

- Named ranges and structured references

2. Budgeting and Forecasting

Overview:

Excel is widely used by finance teams to prepare and manage budgets and forecasts. Its tabular layout and calculation features make it easy to project revenue, costs, and profits.

Key Applications:

- Departmental Budgeting: Track expenses across departments, categories, and time periods.

- Rolling Forecasts: Update projections monthly or quarterly based on new information.

- Variance Analysis: Compare actuals vs. budgeted figures to assess performance.

Useful Excel Tools:

- Conditional formatting to highlight over- or under-budget items

- PivotTables for grouping and summarizing data

- Excel Tables for dynamic range referencing

- Charts and Sparklines for visual presentation of trends

3. Scenario Analysis and What-If Modeling

Overview:

Scenario analysis allows analysts to test multiple assumptions and see how they impact financial outcomes. Excel is ideal for building models that include best-case, base-case, and worst-case scenarios.

Key Applications:

- Revenue Scenarios: Forecast earnings under various market conditions

- Expense Impact: Understand how changes in raw material costs or wages affect profit margins

- Interest Rate Sensitivity: Analyze debt service costs under fluctuating rates

Useful Excel Tools:

- Data Tables (1-variable and 2-variable)

- Drop-down menus with Data Validation for user-driven inputs

- CHOOSE, OFFSET, and INDEX for dynamic scenario selections

- Power Query for importing alternative datasets automatically

4. Valuation and Investment Analysis

Overview:

Excel is extensively used in corporate finance, equity research, and investment banking to value assets and companies. Whether analyzing a bond’s yield or valuing a startup, Excel offers tools to simplify complex valuation models.

Key Applications:

- Comparable Company Analysis (Comps)

- Precedent Transaction Analysis

- DCF Models and Terminal Value Calculations

- Return Calculations for Portfolios

Useful Excel Tools:

- XIRR and XNPV for irregular cash flow valuation

- Lookup formulas like VLOOKUP, INDEX-MATCH, and XLOOKUP for pulling financial metrics

- Custom macros for automating repetitive valuation tasks

5. Ratio and Trend Analysis

Overview:

Ratio analysis is a quick way to interpret a company’s financial health, performance, and efficiency. Excel allows you to automate the calculation of dozens of financial ratios.

Key Applications:

- Liquidity Ratios: Current ratio, quick ratio

- Profitability Ratios: Gross margin, net margin, ROE, ROA

- Leverage Ratios: Debt-to-equity, interest coverage

- Efficiency Ratios: Inventory turnover, asset turnover

Useful Excel Tools:

- IFERROR to cleanly handle calculation issues

- Conditional formatting to highlight red flags

- Dashboard elements for quick visuals

- Rolling averages and trend formulas using AVERAGE, TREND, or LINEST

6. Cash Flow Management

Overview:

Cash is king in any business, and Excel helps track, manage, and forecast cash flow with precision. Creating direct or indirect cash flow statements is simple and customizable.

Key Applications:

- Cash Inflow and Outflow Tracking

- Short-Term Cash Forecasting

- Working Capital Optimization

- Break-even Analysis

Useful Excel Tools:

- SUMIFS and COUNTIFS for date-based filtering

- Charts to visualize cash flow over time

- Waterfall charts for cash flow breakdowns

- Dynamic named ranges for live updates

7. Data Cleaning and Transformation

Overview:

Before any financial analysis, you need clean, structured data. Excel’s Power Query tool helps automate the cleanup of raw datasets from accounting systems, databases, or external files.

Key Applications:

- Removing Duplicates and Errors

- Splitting and Merging Columns

- Consolidating Data from Multiple Sources

- Mapping Accounts Across Systems

Useful Excel Tools:

- Power Query Editor for transformations

- TRIM, CLEAN, SUBSTITUTE, and TEXT functions

- Remove Duplicates feature

- Flash Fill for pattern recognition

8. Dashboards and Data Visualization

Overview:

Excel dashboards provide a dynamic way to display key financial metrics to stakeholders. While not as powerful as BI tools like Tableau, Excel can still produce interactive, visually appealing dashboards.

Key Applications:

- KPI Dashboards

- Executive Summary Reports

- Investor Presentations

- Sales and Revenue Tracking

Useful Excel Tools:

- Slicers and PivotCharts for filtering visuals

- Gauge charts and bullet graphs for KPIs

- Camera tool for creating real-time visual tiles

- Named ranges for dynamic chart sources

9. Auditing and Error Checking

Overview:

Financial models can become complex, and errors are easy to overlook. Excel has several built-in tools for auditing formulas and ensuring model accuracy.

Key Applications:

- Identifying Broken Formulas

- Tracing Precedents and Dependents

- Circular Reference Detection

- Version Control and Change Tracking

Useful Excel Tools:

- Formula Auditing Toolbar

- FORMULATEXT function for documenting logic

- Watch Window to monitor key cells

- Excel’s Cell Styles to flag inputs, outputs, and assumptions

10. Collaboration and Version Control

Overview:

Financial analysis often involves multiple stakeholders. Excel supports collaboration through shared workbooks, comments, and file versioning.

Key Applications:

- Team Budget Reviews

- Shared Financial Forecast Models

- Comment Threads and Notes

- Approval Workflows

Useful Excel Tools:

- Excel Online for real-time editing

- Comments and threaded discussions

- Workbook protection and password locks

- Version history in OneDrive or SharePoint

11. Automation Through Macros and VBA

Overview:

For repetitive financial processes, Excel’s automation capabilities save time and reduce human error. While Excel macros are often underutilized, they can perform powerful tasks.

Key Applications:

- Automating Financial Reports

- Creating Reusable Financial Templates

- Data Import and Cleansing Scripts

- Complex Calculation Loops

Useful Excel Tools:

- Record Macro feature for beginners

- Visual Basic Editor for custom scripts

- User-defined functions (UDFs)

- Button-triggered macros for easy access

12. Integrating Excel with External Data Sources

Overview:

Modern Excel can connect directly to a variety of financial systems, databases, and APIs. This transforms Excel from a static tool into a live data hub.

Key Applications:

- Pulling Live Stock Market Data

- Connecting to SQL Databases

- Importing ERP System Reports

- Linking Excel to Bloomberg or Reuters Terminals

Useful Excel Tools:

- Power Query connections to databases and web services

- ODBC/SQL integration

- Office Scripts for connecting Excel with Microsoft 365 apps

- Dynamic arrays for working with imported tables

Excel Best Practices for Financial Analysts

To make the most of Excel’s capabilities, follow these foundational best practices:

- Keep Inputs, Calculations, and Outputs Separate: Structure your workbook clearly.

- Document Assumptions: Use comment boxes or a dedicated notes tab.

- Avoid Hardcoding: Use cell references and named ranges for assumptions and drivers.

- Use Consistent Formatting: Apply color coding for inputs (blue), formulas (black), and outputs (green).

- Regularly Audit Formulas: Use the formula auditing tools to avoid errors.

- Version Control: Save incremental versions of your models to backtrack when needed.

Advanced Excel Techniques for Financial Analysts

Once the basics of Excel are mastered, finance professionals often look to expand their skill set with more advanced techniques. These advanced tools and methods help analysts work more efficiently, handle larger data sets, and build models that are more dynamic, scalable, and robust.

1. Power Query for Data Preparation

Power Query is a powerful built-in feature in Excel that allows users to connect, clean, transform, and combine data from various sources without manual entry. For financial analysts, this means they can:

- Import transactional data from accounting systems, ERPs, or CSV files

- Automatically remove duplicates, filter out irrelevant records, and reshape the data

- Merge different data sources such as revenue reports and cost centers

The advantage of Power Query is that it automates data preparation, so recurring reports become faster and less prone to error.

2. Power Pivot and Data Models

Power Pivot extends Excel’s capabilities by allowing analysts to create complex data models using multiple tables and relationships. With Power Pivot, you can:

- Build dashboards that pull from large datasets without slowing down the workbook

- Use DAX (Data Analysis Expressions) to create calculated columns and measures

- Combine multiple sources—such as sales, expenses, and headcount—into a unified model

Power Pivot is particularly useful in corporate finance, where data often comes from different departments or systems and needs to be analyzed cohesively.

3. Dynamic Arrays and New Excel Functions

Recent updates to Excel have introduced dynamic array functions, which simplify common tasks and make models easier to maintain. Key functions include:

- FILTER: Extracts data based on criteria without using helper columns

- SORT and SORTBY: Organizes data in ascending or descending order

- UNIQUE: Quickly removes duplicate entries from a range

- SEQUENCE: Generates a series of numbers for indexing or simulation purposes

These functions reduce the need for nested formulas and allow for more readable, adaptable spreadsheets—especially useful when building interactive models or dashboards.

4. Advanced Formula Techniques

Experienced financial analysts often leverage advanced formula combinations to create smarter models. Examples include:

- INDEX-MATCH or XLOOKUP instead of VLOOKUP for faster and more flexible lookups

- OFFSET or INDIRECT for dynamic range selection (used with caution due to performance implications)

- SUMPRODUCT for multi-criteria calculations

- CHOOSE + MATCH for dynamic scenario analysis

These techniques enable greater control over calculations and allow for more user-friendly models where inputs drive outputs in real time.

5. Automation Using Macros and VBA

For repetitive tasks like generating monthly reports or running routine analyses, Excel’s macro recorder and Visual Basic for Applications (VBA) allow users to automate processes. With a few lines of code or a recorded macro, you can:

- Format reports with consistent styling and layout

- Update datasets from external sources

- Trigger complex workflows with a single click

While VBA is not essential for every analyst, learning the basics can significantly reduce manual effort for recurring tasks.

Excel’s Role Across Financial Careers

Excel’s utility extends across virtually every role within the finance function. While the core principles are the same—data organization, analysis, and reporting—the specific applications vary depending on the context and responsibilities of the role.

Investment Banking and Private Equity

In high-stakes deal environments, Excel is used to build:

- Merger models, including accretion/dilution and synergy projections

- LBO (leveraged buyout) models that simulate debt repayment and IRR over time

- Comparable company and precedent transaction analyses

Speed, accuracy, and formatting are critical in these roles. Excel shortcuts, consistent styling, and modular model design are expected skills.

Corporate Finance and FP&A

Financial planning and analysis teams rely heavily on Excel to:

- Manage rolling forecasts

- Build dynamic budgeting templates

- Conduct variance analysis between forecasted and actual results

- Model cash flow projections and scenario impacts

Templates are often reused quarter to quarter, making modularity and input control essential.

Accounting and Audit

Accountants and auditors use Excel to:

- Reconcile trial balances and subledger accounts

- Validate transactions and calculate accruals

- Document and test internal controls

- Analyze year-over-year financial statement trends

In these roles, Excel serves as a flexible calculator, data store, and documentation tool all in one.

Equity Research and Asset Management

Equity analysts often construct Excel models to:

- Forecast earnings and value companies using DCF or multiples

- Conduct sensitivity analysis on earnings per share (EPS)

- Track historical performance across peer groups or sectors

- Generate charts and tables for investor reports

Excel remains the primary interface between raw data and publishable insights in these environments.

Small Business and Freelance Finance

For small business owners or freelance financial consultants, Excel offers:

- Invoicing templates and cash flow tracking

- Pricing calculators and break-even models

- Personal finance and tax estimators

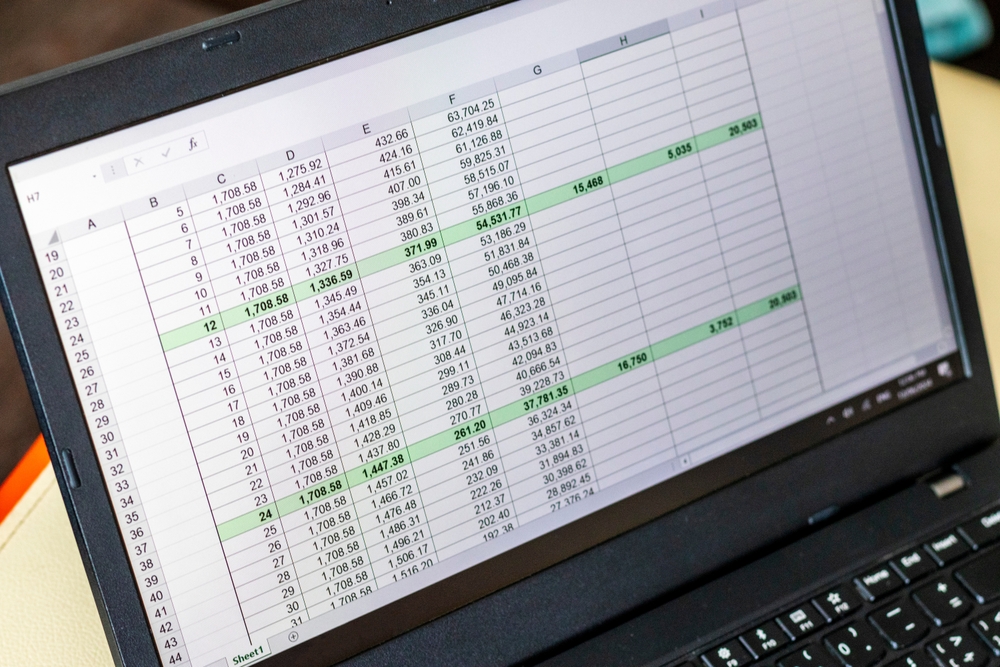

- Loan amortization schedules and funding scenario planning

Because small businesses often lack access to expensive accounting software, Excel becomes the default system for both bookkeeping and strategic planning.